Bundelio

Debt Tracker & Repayment Planner Canva Templates – Simplify Budgeting and Pay Off Debt Faster

Debt Tracker & Repayment Planner Canva Templates – Simplify Budgeting and Pay Off Debt Faster

Couldn't load pickup availability

Stay Organized and Pay Off Debt Smarter with Editable Canva Debt Trackers

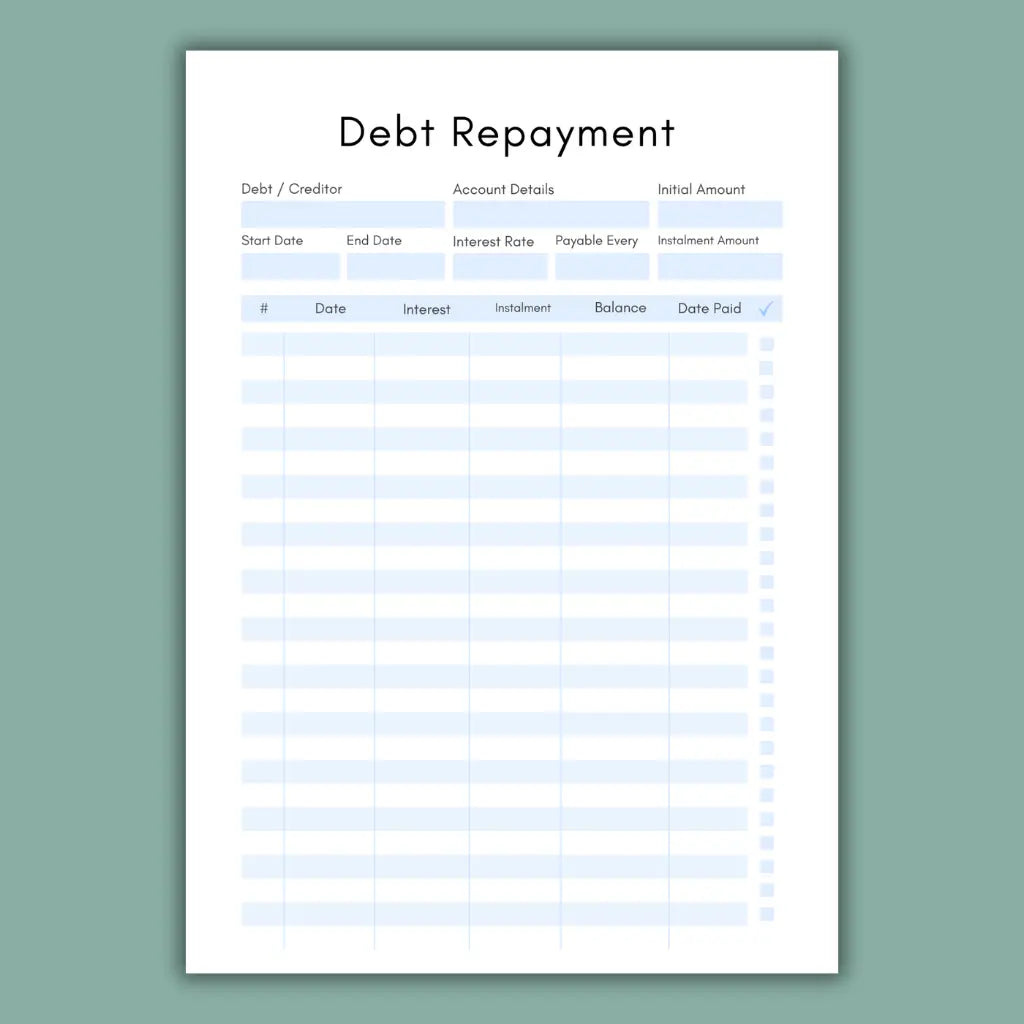

Managing multiple debts, credit cards, or student loans can feel overwhelming. Without a clear system, it’s easy to lose track of payments, interest, and progress. This Debt Tracker & Repayment Planner Canva Template helps you simplify money management and finally take control of your finances.

Who This Planner Is For

Perfect for individuals, families, and small business owners who want to:

- Track credit card, loan, or student debt repayments with ease

- Stay motivated with visual progress trackers

- Organize repayment schedules in one clean layout

- Use a ready-to-edit Canva template without design skills

What You’ll Achieve

By using this editable Canva debt repayment planner, you’ll be able to:

- Monitor balances, due dates, and interest rates clearly

- Plan ahead using debt snowball or avalanche strategies

- See your repayment progress at a glance with visual charts

- Reduce stress by keeping all debt information in one place

How It Works

Simply open the template in Canva, customize it with your own debt information, and start updating your progress each month. No complicated spreadsheets, no need for design skills — just print or use digitally for efficient financial tracking.

Why Choose This Debt Planner

Unlike generic budgeting sheets, this Canva debt tracker template is professionally designed, minimal, and easy to use. It covers debt repayment, progress tracking, snowball planning, and weekly payoff challenges — giving you multiple ways to stay consistent on your journey to financial freedom.

Take charge of your financial future today. Download the Debt Tracker Planner and start paying off debt with clarity and confidence.

Share