Bundelio

Budget Trackers Planner Canva – Save Smarter, Pay Off Debt & Reach Financial Goals

Budget Trackers Planner Canva – Save Smarter, Pay Off Debt & Reach Financial Goals

Couldn't load pickup availability

Take Control of Your Money with the Budget Trackers Planner in Canva

Managing personal finances can feel overwhelming—paychecks disappear quickly, debt payments pile up, and emergency savings never seem to grow. The Budget Trackers Planner is designed to help you take back control, stay organized, and finally achieve financial peace of mind.

What is the Budget Trackers Planner?

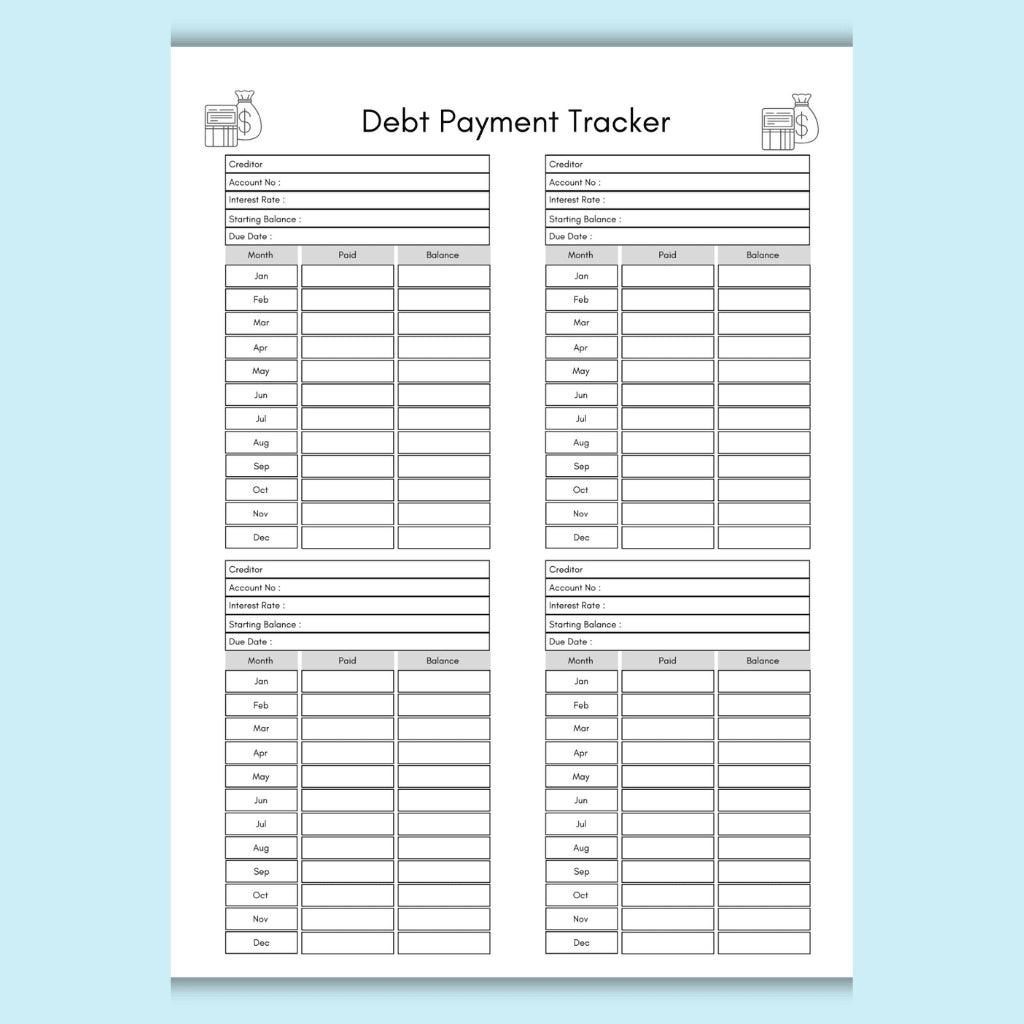

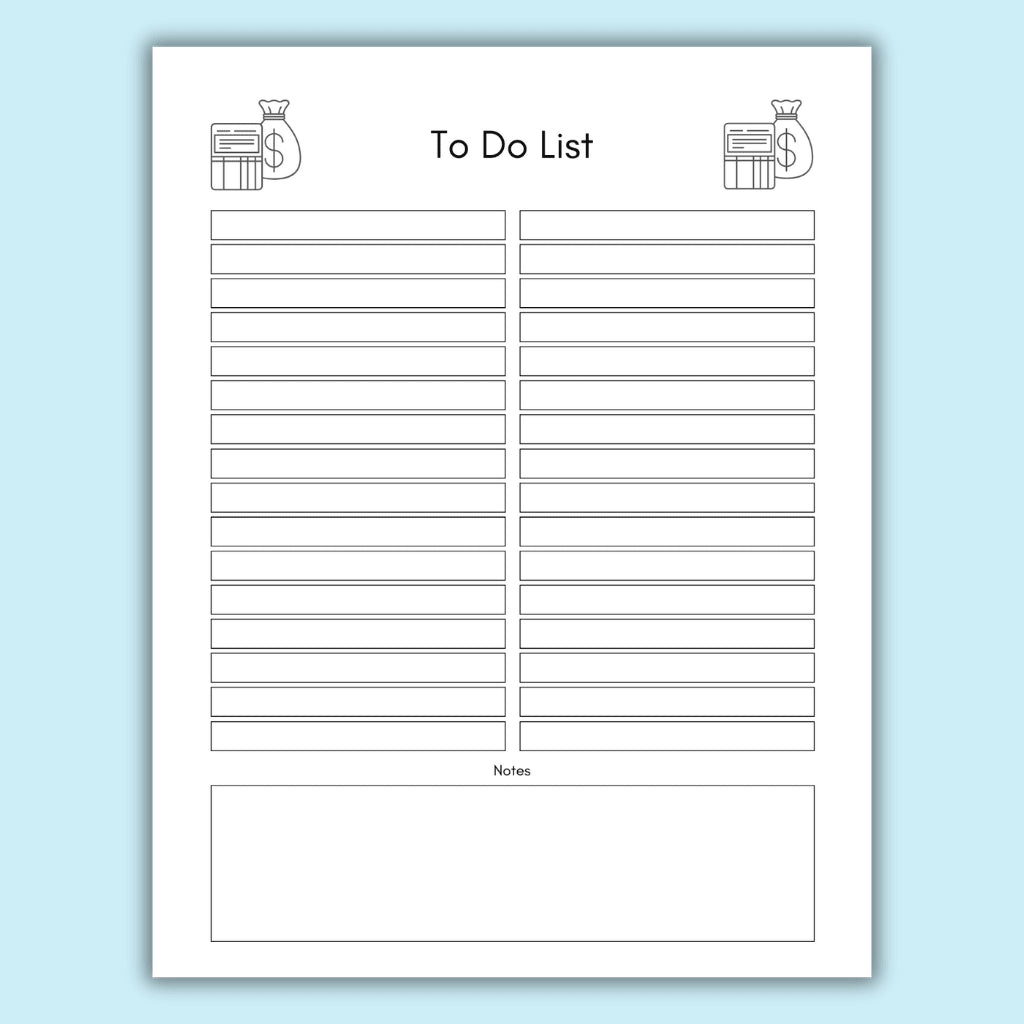

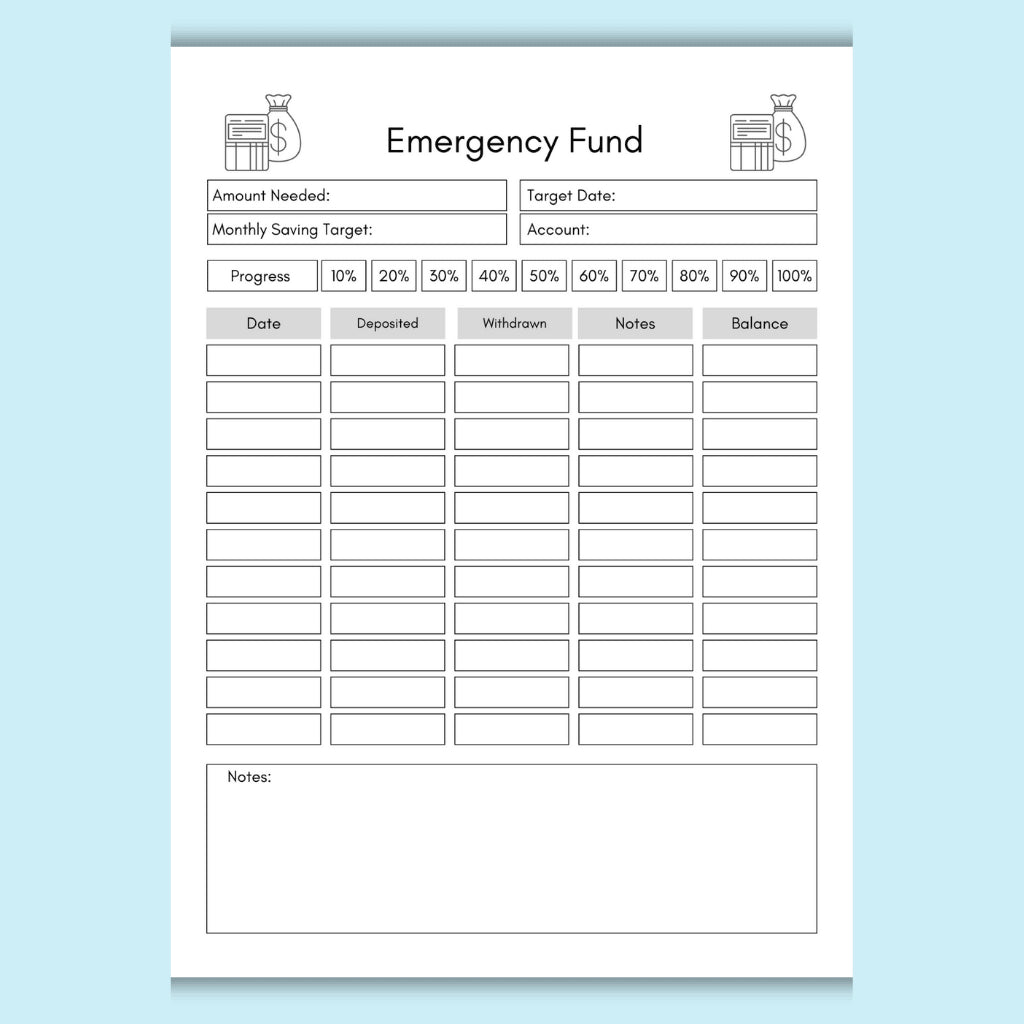

The Budget Trackers Planner is a ready-to-use Canva template that includes all the essential financial trackers you need. It comes with an Emergency Fund Tracker, Debt Payment Tracker, Net Worth Tracker, Sinking Funds, Retirement Planner, and even a To-Do List. Each page is designed to make budgeting simple, visual, and stress-free. You can easily customize it in Canva to fit your personal financial goals.

Who is it for?

This planner is perfect for anyone who wants to organize their money more effectively. Whether you’re a student, professional, freelancer, or a family working toward shared financial goals, this planner will help you save more, reduce debt, and plan for the future with clarity.

What You’ll Achieve

- Organize your finances with easy-to-use, visual trackers.

- Reduce money stress by having a clear picture of income, expenses, and savings.

- Reach financial goals faster—from building an emergency fund to paying off credit cards.

- Flexible & accessible digital format—edit anytime in Canva without extra tools or apps.

How It Works

After purchase, you’ll instantly receive a Canva link to your planner. Simply open it, add your numbers, and start tracking your finances. No complicated apps or subscriptions—just a simple, customizable system to help you stay on top of your money.

Start Building Better Money Habits Today

Don’t wait another month to get your finances under control. Get the Budget Trackers Planner Canva now and take the first step toward saving more, paying off debt, and creating a stronger financial future.

Share